- The Exponential Blueprint

- Posts

- 10 Game-Changing Startups. One Shared Weakness.

10 Game-Changing Startups. One Shared Weakness.

Innovation is everywhere. Investability is not.

Make money cleaning up the planet.

TerraCycle has spent two decades solving one of the biggest problems on Earth: trash.

By partnering with hundreds of global brands like Coca-Cola, Unilever, and Whole Foods, they’ve created profitable recycling solutions for “unrecyclable” materials.

With more than 10 years of profitability and steady dividend payouts to investors, TerraCycle is proving that doing good can pay off.

Now, you can invest directly in their mission and get 15% bonus stock.

This is a paid advertisement for TerraCycle’s Regulation CF offering. Please read the offering circular at https://invest.terracycle.com/

My Lecturing and Mentorship in Riyadh

It was a long week — ten back-to-back meetings with founders across biotech, medtech, healthtech, AI, sustainability, and regenerative science. Ten different visions. Ten different markets. Ten different personalities. But one unmistakable pattern:

Breakthrough ideas are abundant. Breakthrough businesses are rare.

What struck me wasn’t the innovation — that part was extraordinary. What struck me was how consistently brilliant founders underestimate the gap between technology and valuation.

It’s a gap I’ve seen ruin promising businesses for 29 years.

And it’s a gap the High Valuation Triangle exposes ruthlessly.

1. The Founder With the Material That Could Change Wound Care Forever

One founder showed me a natural biological material with regenerative properties strong enough to potentially replace expensive and invasive current methods. Their science was elegant. Their aspiration was global.

But the sequencing was off.

They were ready to pursue three product lines before even proving one. They were planning global regulatory filings before locking in their IP. They were thinking scale before validation.

My High Valuation Triangle evaluation:

IP Monetisation: 2/5 (the defensibility exists — but IP isn’t filed early enough)

Succession/Leadership Depth: 3/5 (brilliant scientist, still building the commercial team)

Going Global: 2/5 (ambition is global, strategy is not yet)

This is the most common deep-tech trap:

A world-changing insight without a world-ready structure.

2. The AI Team Replacing a Painful Medical Procedure With Pure Intelligence

Another team built a model that mimics a diagnostic process that currently requires invasive testing. If their accuracy holds, they could remove risk, reduce cost, and speed up diagnosis globally.

But their biggest challenge wasn’t accuracy.

It was data governance, regulatory planning, and reimbursement strategy.

They didn’t need more AI.

They needed a CFO who could build the road from “promising” to “viable.”

High Valuation Triangle evaluation:

IP Monetisation: 4/5 (clear data advantage, scalable algorithm)

Succession/Leadership Depth: 2/5 (single-founder knowledge dependency)

Going Global: 3/5 (export potential high, pathway still shallow)

3. The Deep-Biology Company Mapping the Kidney at Cellular Level

Imagine digitising an entire organ — every pathway, every interaction, every response — to simulate how it behaves in health and in disease. That’s the level of ambition behind one of the teams I met.

Their challenge was not science.

It was storytelling.

It was explaining to investors — in simple, compelling language — why this matters, how it saves billions, and where the revenue comes from.

High Valuation Triangle evaluation:

IP Monetisation: 3/5 (powerful asset, but the business model is not communicated clearly)

Succession/Leadership Depth: 3/5 (small but strong technical team)

Going Global: 4/5 (immediate international relevance)

4. The Genetics Startup Turning Population Data Into Prediction Power

This team built AI that predicts chronic disease risk using real medical records. Their accuracy was impressive — validated across tens of thousands of cases.

But their weakness was alignment:

Scientific leadership and commercial leadership were not on the same page.

Great companies don’t rise on intelligence alone.

They rise on integration — science, strategy, and structure moving as one.

High Valuation Triangle evaluation:

IP Monetisation: 4/5 (strong technical defensibility)

Succession/Leadership Depth: 2/5 (leadership silos)

Going Global: 3/5 (regional traction strong, global path emerging)

5. The Climate-Tech Founder Turning Waste Into Value

Another team couldn’t be more different — instead of AI models and genomics, they were using pyrolysis to transform agricultural waste into carbon credits, soil enhancers, and clean energy.

Their challenge wasn’t technology.

It was complexity.

Too many revenue streams, too early. Too many expansion ideas before establishing a single beachhead.

High Valuation Triangle evaluation:

IP Monetisation: 3/5 (defensible process, unclear licensing strategy)

Succession/Leadership Depth: 4/5 (strong operators, execution-focused)

Going Global: 3/5 (ASEAN ready, global ambition credible)

6. The Precision-Medicine Team Targeting One of the Most Devastating Cancers

One startup had developed biomarkers that could radically improve early detection and transplant success in a disease that kills hundreds of thousands each year.

Their science is robust. Their team is sophisticated. Their clinical data is compelling.

But their global expansion plan needs sharper sequencing:

Saudi → Europe → US.

Not the other way around.

High Valuation Triangle evaluation:

IP Monetisation: 5/5 (biomarkers = extremely strong IP)

Succession/Leadership Depth: 4/5 (seasoned medical leadership)

Going Global: 3/5 (ambition high, roll-out timing needs refinement)

The Pattern: Innovation Without Architecture

Across all ten meetings, I kept seeing the same truth:

Most founders don’t have a science problem.

They have a structure problem.

They have IP but need to complete IP strategy.

They have data but no regulatory roadmap.

They have a prototype but no financial sequencing.

They have ambition but no operational depth.

They have global dreams but no global mechanics.

The High Valuation Triangle reveals it without mercy.

If You’re a Founder Reading This…

You may see yourself in one of these stories.

Not because you lack intelligence — quite the opposite — but because deep-tech founders live so deeply inside their science that they underestimate the architecture required to turn it into a high-valuation company.

Innovation creates potential.

Structure creates valuation.

Sequencing creates scalability.

Leadership creates resilience.

Global strategy creates relevance.

When all three sides of the High Valuation Triangle align —

that’s when funding accelerates, hiring becomes easier, and valuation multiplies.

If you want help building the architecture behind your innovation — reply to this email, or send me a message.

I can help you structure what you’ve created into something investors recognise instantly as fundable, scalable, and globally relevant.

Because your science deserves it.

And so does your ambition.

Here are the new articles this week:

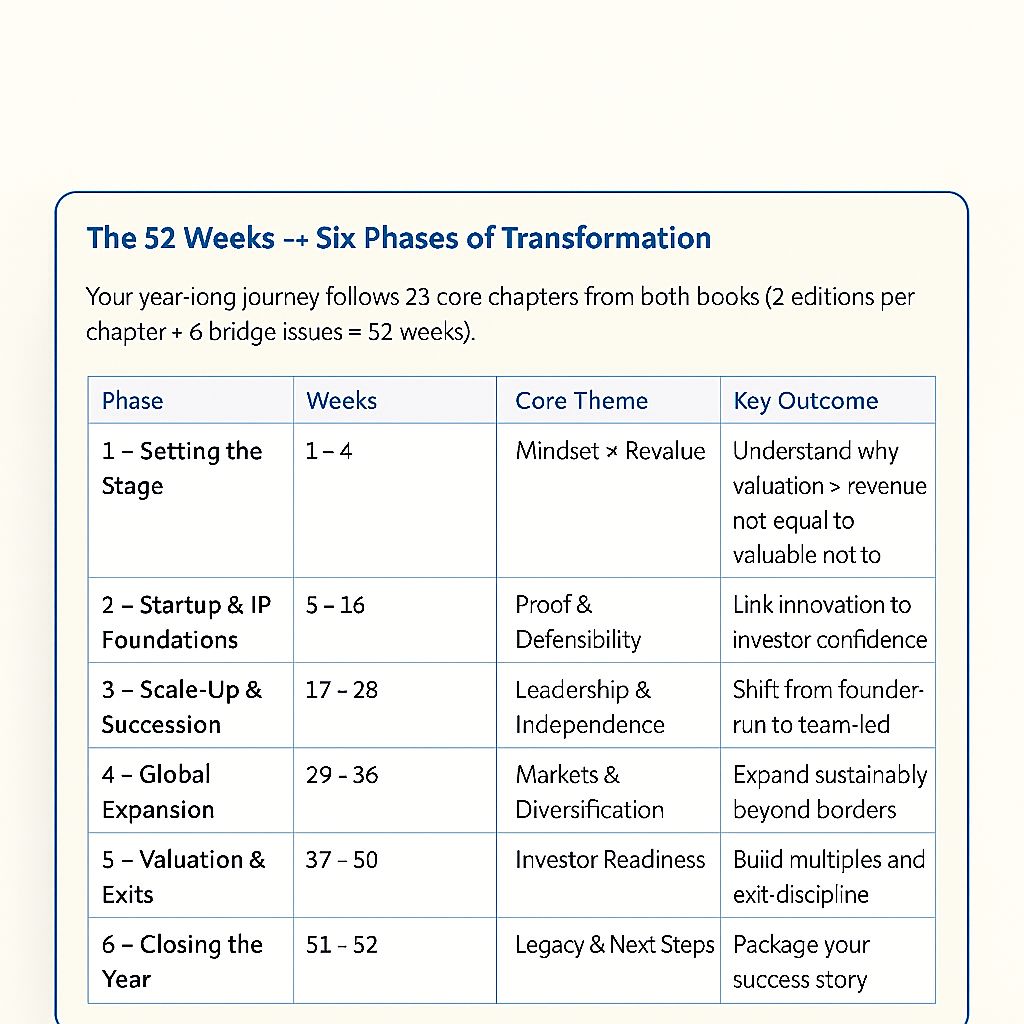

P.S. A quick update: The High Valuation Code — my 52-week system for helping founders build investor-ready, high-value companies — has now been formally approved by ClickBank.

This means it’s gone through a full compliance review and meets the standards required for global distribution.

If you want to access the same frameworks I use with founders and investors every week — or if you want to promote it as an approved ClickBank product — you can reply to this email and I’ll share the details.

Until next week.

To your Exponential Success,

Matteo Turi

_________________________________________

About the Author

Matteo Turi is a UK-based Chartered Accountant (ACCA), CFO, Board Director (FT Board Director Program), and author of the upcoming book "Fail. Pivot. Scale."

He is the creator of the High Valuation Triangle™, a system that helps businesses engineer valuation growth through intellectual property, leadership depth, and global scalability.

Matteo also writes The Exponential Blueprint, a finance and entrepreneurship newsletter read by 22,000+ founders and investors.

From October 2025, Matteo has become Executive Contributor with the Brainz Magazine.

Connect on LinkedIn for insights on scaling with resilience and purpose.

Reply