- The Exponential Blueprint

- Posts

- From 0.7% to 7%: How Finance Redefined Growth

From 0.7% to 7%: How Finance Redefined Growth

A $100M business, one bold pivot: from chaotic growth to profitable structure

When Profit Becomes a Design Choice

Most leaders think profit is a result.

But in reality, profit is a design choice.

Years ago, I joined a $100 million recruitment business spread across three continents. It was an impressive company on paper — big offices, big clients, big ambition. Yet, when I opened the books, one number stood out:

Net profit = 0.7%.

That’s not a margin.

That’s survival disguised as success.

The Real Obstacle: Growth Without Structure

The company had energy but no structure. Sales were celebrated, but margin discipline was forgotten. Every deal closed felt like a win — even when it wasn’t profitable.

Finance was treated as an afterthought, a back-office function that “kept score” instead of driving the game. And like so many mid-market businesses, it had fallen into the illusion that growth automatically equals value.

It doesn’t.

In this case, the faster they grew, the thinner their margins became.

Shoppers are adding to cart for the holidays

Over the next year, Roku predicts that 100% of the streaming audience will see ads. For growth marketers in 2026, CTV will remain an important “safe space” as AI creates widespread disruption in the search and social channels. Plus, easier access to self-serve CTV ad buying tools and targeting options will lead to a surge in locally-targeted streaming campaigns.

Read our guide to find out why growth marketers should make sure CTV is part of their 2026 media mix.

The Breaking Point

Here’s the truth few want to hear:

You can’t scale chaos.

When revenue grows on weak foundations, losses grow faster.

And the people who should be the architects of discipline — the finance team — are too often left out of the strategy room.

The result?

• Sales teams competing internally instead of collaborating.

• Clients being priced inconsistently across regions.

• Entire contracts being renewed at negative margins because “we didn’t want to lose the client.”

The problem wasn’t effort. It was structure.

The Strategic Pivot

In my first week, I met every regional sales leader and asked one question:

“If you doubled your sales tomorrow, what would your profit be?”

No one could answer.

That’s when I knew — finance had to move from being a reporting function to being the strategic centre of gravity.

We didn’t start with layoffs or cost-cuts. We started with clarity.

We reorganized the entire sales structure from one profit centre to four. Each became a self-contained unit, responsible for its own P&L.

Suddenly, accountability was visible.

Leaders could see — in real time — which products, regions, and clients were building value and which were eroding it.

And then came the line in the sand:

“No business unit will operate below a 20% margin.”

It was non-negotiable.

Not as a dream, but as a rule.

The Result of Discipline

Six months later, net profit went from 0.7% to 7%.

Same people.

Same products.

Same markets.

Different structure.

The difference wasn’t magic — it was discipline.

And this is the part many founders underestimate:

Growth isn’t what creates profit.

Structure creates profit.

Then profit creates growth that lasts.

Do you want to join a $13 trillion Private Capital Market? Watch this podcast with Veronika Oswald, Director of JP Jenkins, a private capital expert with 34 years experience in private market listing.

The Broader Lesson — Fail. Pivot. Scale.

That transformation became one of the defining lessons of Fail. Pivot. Scale — my upcoming book on turning financial chaos into scalable value.

Every business will hit a wall.

Some fail because they never adapt.

Others pivot — and reinvent the system from the inside out.

The rare few scale — because they turn finance into the DNA of every decision.

This story wasn’t about spreadsheets. It was about culture. Once the teams started thinking like investors, not just operators, everything changed.

They began asking new questions:

• How does this deal affect our unit margin?

• What’s the cost of growth if we chase unprofitable clients?

• How can we use pricing as a strategy, not a reaction?

That shift — from activity to profitability — is what separates a busy company from a valuable one.

Two Case Studies — Same Principle, Different Endings

Apple: Controlling Margins Before Scaling Volume

In the early 2000s, Apple was not yet the trillion-dollar giant we know. But it made one fundamental decision that mirrors what we did in that recruitment company: control margins before scaling volume.

Apple’s leadership understood that profit discipline funds innovation.

They created product lines with clear margin thresholds, refused to engage in price wars, and positioned finance as a creative partner, not a limiter.

As a result, Apple turned every product — from iPod to iPhone — into a self-funding profit centre. Finance didn’t slow them down; it made their imagination sustainable.

Apple didn’t just make devices.

It designed profitability into its DNA.

WeWork: Expansion Without Architecture

WeWork grew faster than almost any company in history — yet every new location was a financial black hole. Its leadership celebrated expansion instead of efficiency.

There were no true profit centres, no accountability for margin, and no realistic ceiling for costs. Finance was brought in to justify the dream, not to measure the risk.

WeWork mistook revenue for value and paid the price.

The collapse wasn’t sudden. It was engineered by omission — the absence of financial architecture.

The Invitation

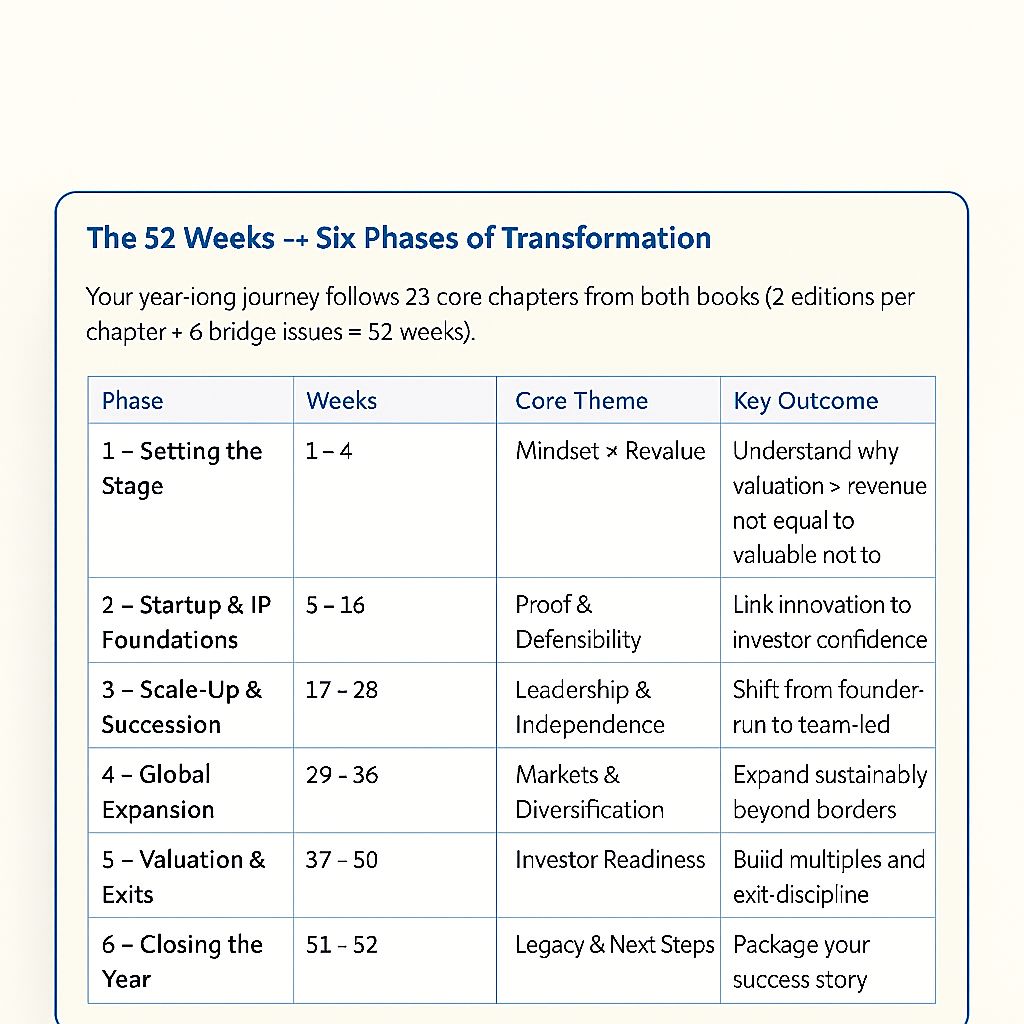

If you found this story useful, it’s only a glimpse of what’s inside The High Valuation Code — my 52-week program inspired by Fail. Pivot. Scale.

Each week we unpack real case studies, valuation frameworks, and interactive scorecards that help founders, CFOs, and CEOs move from “busy” to “valuable.”

This is where we go deep into how to:

• Turn finance into a competitive weapon

• Build profit centres that scale sustainably

• Design valuation into your daily decisions

Only 25 seats open each month — and they close on the 7th.

If you’re ready to turn 0.7% into 7% — and beyond —

Join The High Valuation Code today.

Our M&A Expert Corner, Marguerite Bolze from Indonesia

Beyond the Acquired: Supporting the M&A Integration Team

It is widely recognized that employees of an acquired company face significant stress during a merger or acquisition (M&A) process. However, we often overlook the intense strain placed on the employees leading the integration. These individuals, who are typically from the acquiring firm or are key personnel on both sides, are frequently tasked with working twice as hard—managing their full-time operational responsibilities while simultaneously driving complex integration tasks—often without additional compensation or recognition. Failing to acknowledge and support this group creates a major risk, as their exhaustion and frustration can lead to burnout, increase attrition, and generate significant internal resistance. Ultimately, neglecting the needs of the integration support team will directly deter the speed and success of both cultural alignment and operational integration.

--------------------------------------------

Contact us to build your tailored 90-Day Activation Blueprint!

Marguerite Bolze

Conclusion: From Growth Addiction to Valuation Intelligence

Whether you’re Apple, WeWork, or a $100 million recruitment company — the principle is universal:

You don’t scale by selling more.

You scale by knowing what’s worth selling.

Profit isn’t a reward for hard work. It’s the signal that your system works.

And when finance becomes the point of reinvention, you move from firefighting to forecasting.

That’s the real pivot — from growth addiction to valuation intelligence.

To Your Exponential Success,

Matteo Turi

About the Author

Matteo Turi is a UK-based Chartered Accountant (ACCA), CFO, Board Director (FT Board Director Programme ), and author of the upcoming book "Fail. Pivot. Scale."

He is the creator of the High Valuation Triangle™, a system that helps businesses engineer valuation growth through intellectual property, leadership depth, and global scalability.

You can join the premium newsletter "The High Valuation Code" for $19.95/month, and you will receive 1,040 valuation scorecard points during the program.

Here is how to join : The High Valuation Code : The High Valuation Code

From October 2025, Matteo has become Executive Contributor with the Brainz Magazine.

Connect on LinkedIn for insights on scaling with resilience and purpose.

Reply