- The Exponential Blueprint

- Posts

- Protect & Profit: How to 10X Investor funding

Protect & Profit: How to 10X Investor funding

From overlooked to overfunded in 12 months or less.

Former Global Sales Director launches £100k/month Closing School

The highest-paid people in business aren’t the CEOs. They’re the closers.

In fact, top closers regularly earn £100K+ per month, fueled by the explosive growth of online sales and high-ticket offers.

That’s why entrepreneurs and sales pros are lining up for the £100K/Month Closing School. Launching September 20th, it’s the first Skool community dedicated to turning aspiring closers into elite performers—with live coaching, deal breakdowns, offer feedback, and even cash prize competitions.

And here’s the kicker: the first 50 members lock in lifetime access at just £97/month (instead of £147) plus a free 1:1 consult.

Paid advertisement for £100K/Month Closing School.

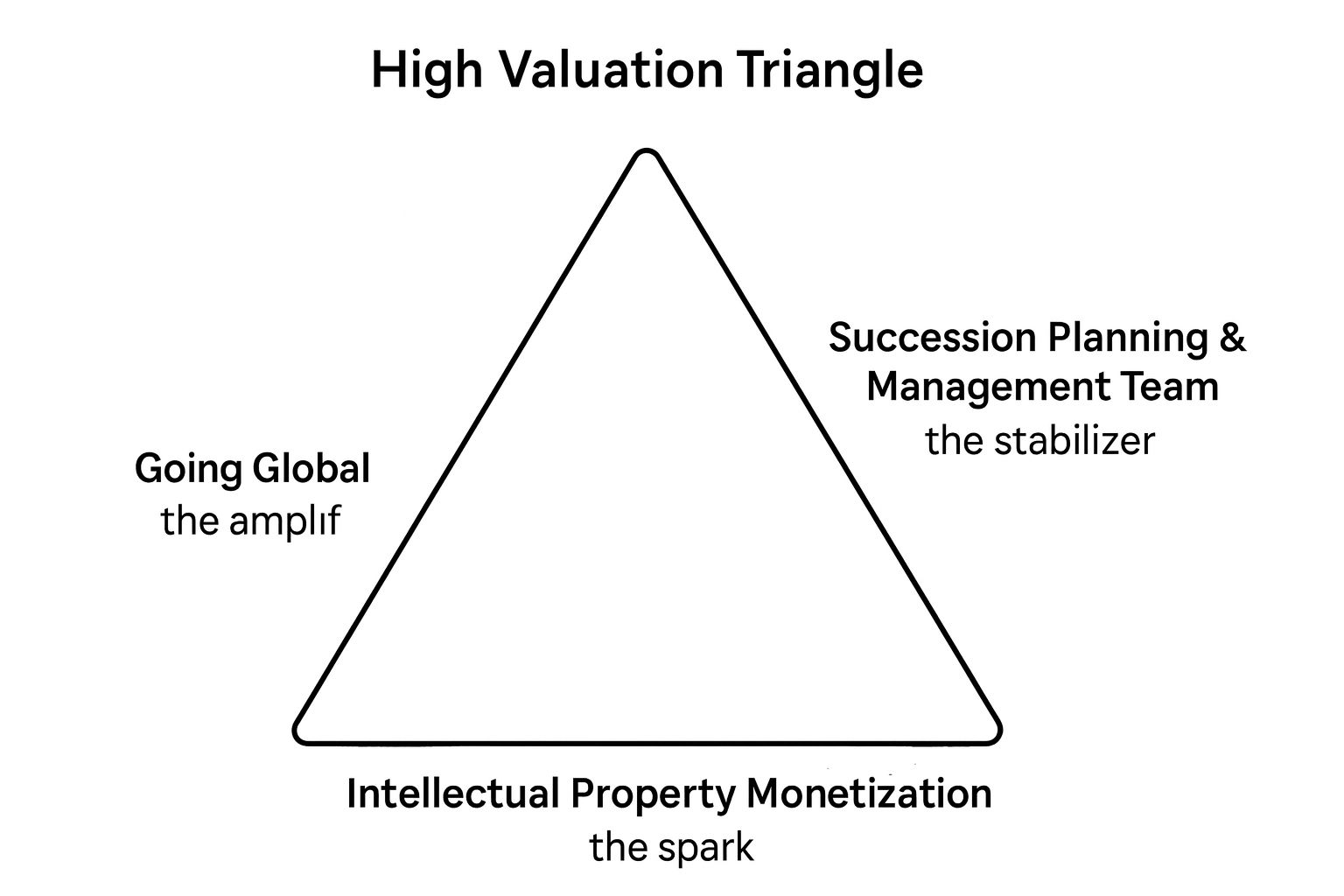

From Invisible to Investable: The High Valuation Triangle in Action

This week’s theme: Why IP Alone Is Not Enough

We talk often about intellectual property (IP) as the engine of high valuation. But here’s the truth: IP without the other two angles of the High Valuation Triangle—succession/leadership and global expansion—will not deliver sustainable wealth.

Think of it this way:

Intellectual Property Monetization – the spark.

Succession Planning & Management Team – the stabilizer.

Going Global – the amplifier.

Why IP Matters for Economies

Measure | Value | Impact | Source |

|---|---|---|---|

Share of GDP from IP-intensive industries (U.S.) | 41% | 62.5M jobs, 44% of total employment | U.S. Patent & Trademark Office (USPTO, 2022 report) |

Share of GDP from IP-intensive industries (EU) | 47% | ~82M jobs, wage premium +41% | EUIPO/EPO “IPR-intensive industries” study, 2022 |

Global cross-border IP flows (2024) | ~$1.0T | ≈0.9% of world GDP; 7.5% of global services trade | WIPO “World IP Indicators 2024” |

Retail sales of licensed products (2024) | $369.6B | 0.32% of world GDP | Licensing International Annual Global Study 2024 |

This isn’t just about information. It’s about transformation.

You’ve put years into building your business.

Now it’s time to make it worth something.

Join a private founder circle built for one thing: multiplying your valuation — with real tools, real strategy, and real momentum.

Inside, you’ll get what founders actually need to grow:

→ Weekly Valuation Scorecards – Get clarity on where your business stands. Measure progress across IP, team readiness, and global potential — so you know what to fix, and when. 1,040 scores in the first 52 weeks.

→ Monthly Live Webinars – Join Matteo for hot seats, frameworks, and no-fluff Q&A. Leave each session with answers you can use tomorrow.

→ In-Person Meetups (Every 6 Months) – Connect with serious founders. Learn, trade notes, and build relationships that move deals forward.

$19.95/month – Stay flexible.

$179.96/year – Save 10% and commit to growth.

Only 99 seats. 73 are already gone.

Just 26 left.

Why now?

Because momentum compounds.

And if you want a higher valuation in 2026 and beyond — the work starts today.

Turn the High Valuation Triangle into your weekly blueprint.

Join us now

IP as a Multiplier for Investors

Startups with protected IP are 10x more likely to raise venture capital.

Source: European Patent Office & European Union Intellectual Property Office joint study “Patents, Trademarks and Venture Capital” (2019).IP-rich firms have a 300% higher chance of a successful exit (acquisition/IPO).

Source: World Intellectual Property Organization (WIPO) and OECD data synthesized in the “Intangible Assets and Value Creation” research (OECD 2021) and reinforced by studies from the UK IPO on exit outcomes.

Why this matters: Investors see IP as both a defensive moat and an asset class. Strong IP portfolios are collateral, proof of uniqueness, and tickets to global scalability.

Two Negative Case Studies

Kodak – patents without adaptation → valuation collapse.

Nokia – thousands of patents, but leadership failed to pivot → lost dominance.

Two Positive Case Studies

Disney – creates, protects, monetizes, scales → global empire.

McDonald’s – franchises as IP monetization → global scale with repeatable system.

Regional Snapshot of Licensed Goods & IP Receipts

Region | Licensed Goods Sales (2023) | Royalty Receipts (2024) | Sources |

|---|---|---|---|

U.S./Canada | $210.3B (59% global) | $152B (≈0.5% of GDP) | Licensing International; World Bank BoP data |

Western Europe | $65.5B (18.4%) | $185B (≈1% of GDP) | Licensing International; World Bank |

North Asia (China, Japan, Korea) | $34.7B (9.7%) | China: $52B; Japan/Korea ~$20B | Licensing International; World Bank |

Latin America | $15B (4.2%) | Brazil: $2–3B | ABF (Brazil Franchise Association); Licensing International |

South Asia/Pacific | $15B (4.2%) | India $1.7B; Australia smaller | World Bank; Licensing International |

ME/Africa | $5.9B (1.7%) | South Africa: franchising ~15% of GDP | Licensing International; Franchise Association of South Africa |

The “Protect and Profit” Path

The 4-Step IP Monetization Scheme:

Create IP – innovate, design, brand.

Protect IP – patents, trademarks, copyrights.

Monetize IP – licensing, franchising, royalties, JVs.

Continue Developing IP – reinvest and expand into global markets.

Many founders assume that just creating intellectual property guarantees monetization. It doesn’t.

IP must follow the Protect and Profit path: first safeguarded, then commercialized.

Without both steps, value slips away.

Consider two cautionary tales.

Napster pioneered peer-to-peer music sharing but never secured licensing protections, leading to lawsuits and collapse while Apple and Spotify later monetized the model.

Yahoo developed powerful search and advertising technologies but neglected to protect and strategically license them, enabling Google to capture the market.

These examples show that creation alone is not enough—protecting IP and building profit channels are essential to avoid being overtaken by better-positioned competitors.

New Podcast Episode: Unlocking Liquidity in Private Markets with Veronika Oswald (JP Jenkins)

In this episode of The Exponential Blueprint, I sit down with Veronika Oswald, Managing Director at JP Jenkins — one of the most innovative private market platforms in Europe.

We dive deep into the real mechanics behind private listings, the future of secondary markets, and why most founders misunderstand what drives valuation.

Veronika shares how JP Jenkins is enabling liquidity for private companies before IPO — and why this matters more than ever in a $23 trillion private market space.

If you’re a founder, investor, or executive preparing for a capital event, this is a must-listen.

We also break down the High Valuation Triangle — IP monetization, succession planning, and global scaling — with real-world case studies.

You don’t want to miss this one.

Takeaway

The High Valuation Triangle is not theory—it is a proven framework:

IP Monetization sparks value.

Succession & leadership sustain value.

Global expansion multiplies value.

Companies that embrace “Protect and Profit” create wealth not only for shareholders, but also for employees, economies, and societies. Those that don’t? They risk becoming the next Kodak or Nokia.

M&A : The Expert Corner, From Indonesia

Culture, both national and organizational, is a crucial but often overlooked factor in M&A success. While last week we had a look at the role of culture in negotiations, this week I would like to go through the impact in Post-Merger integration.

Post-Merger Integration and Cultural Clash

The real impact of a cultural mismatch often becomes most apparent after the deal cloes, during the integration phase - the “us versus them” trap as I like to call it.

Employee Retention: A cultural clash can cause a sense of alienation and uncertainity among employees, particularlt in the acquired company. If the new management style, values, or work environment conflicts with their expectations, it can lead to high employee turnover, a phenomenon known as “brain drain”.

Loss of Synergy: The primary goal of most M&A deals is to achieve synergies, such as cost savings or increased revenue. However, if employees from the two companies are unwilling or unable to collaborate effectively due to cultural differences, these synergies may never be realized.

Operational Disruption: Different working styles can cause operational friction. For example, a fast-paced, agile company might clash with a more bureaucratic, slow-moving one. This can disrupt workflows, lower productivity, and cause projects to stall.

Erosion of Core Values: The acquiring company may try to impose its culture on the target, but if it fails to recognize and preserve the unique strengths of the acquired company’s culture - its “secret sauce” - it can destroy the very value it sought to acquire.

Avoid the “us versus them” trap! Schedule a call with us!

Marguerite Bolze

Below you can watch our recent podcast with Marguerite Bolze.

You don’t need more noise.

You need a strategy that works — and people who get it.

I hope to see your name on the list.

To Your Exponential Success,

Matteo Turi

Chief Financial Officer | The Exponential Blueprint

Reply