- The Exponential Blueprint

- Posts

- The $10M Secret to Scale? A Triangle. Not a Funnel.

The $10M Secret to Scale? A Triangle. Not a Funnel.

You’re not one funnel away. You’re one system away.

This Startup Is Making Plastic Obsolete

Timeplast created a plastic that dissolves in water, leaving no waste. Their tech could revolutionize the $1.3T plastic industry. That’s why 7,000+ people have already invested, and you have only a few days left to join them. Invest in Timeplast by July 31 at midnight.

This is a paid advertisement for Timeplast’s Regulation CF Offering. Please read the offering circular at invest.timeplast.com.

The Moment We Went Live

On July 17th, 2025, we hosted a live webinar:

From Stuck to Scaling – The Founder’s Leap

It wasn’t theory.

It wasn’t another motivational session.

It was a wake-up call — and a blueprint.

What we shared was nearly a decade in the making.

How It All Started (2017 → 2025)

In 2017, I partnered with the University of Plymouth to pilot a question that no one in traditional finance or entrepreneurship dared to ask:

Could startup and mid-market founders apply Fortune 500 valuation strategies—without sacrificing purpose, freedom, or sanity?

Below is the photograph of the 2017 final day with the University of Plymouth

We tested it on five companies. It worked. And we refined it.

2018 – Built the first Scaling Triangle, integrating IP monetization, succession planning, and global licensing strategies.

2019 – Worked with high-growth clients in cleantech, SaaS, and medtech—proving it worked across industries.

2024 – Launched the full 12-month Exponential Blueprint Program:

20 training modules, execution calls, and digital tools to help founders implement what global giants already know.

By 2025, we’ve helped thousands — and we went live to share it with 22,000+ founders, investors, and executives who trust this system.

Every Business Lives in One of Five Stages

Every business—whether bootstrapped or VC-backed—is in one of five stages:

Startup

Scale-up

Stagnation

Crisis

Exit

You’ve been in one. You’re in one now.

And each stage has limiting factors that—if ignored—will pull you backward or burn you out.

The Real Reasons Businesses Fail (By Stage)

Startup

No monetization model

No investor-ready financials

No clarity on customer lifetime value

👉 You’re doing everything. But nothing is scalable.

Below is an illustration of the 3 start-up phases

Scale-up

No delegation model

No IP protection

The founder is still the bottleneck

👉 You’re growing—but it’s grinding you down.

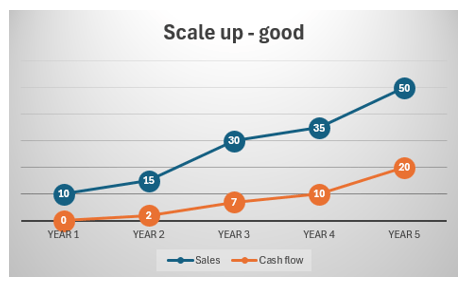

Below is an illustration of a good scale-up example. In this example, the business is converting commercial strength into cash flow generation.

Stagnation

Lack of succession

No global ambition

Systems can’t evolve

👉 The business survives—but no longer thrives.

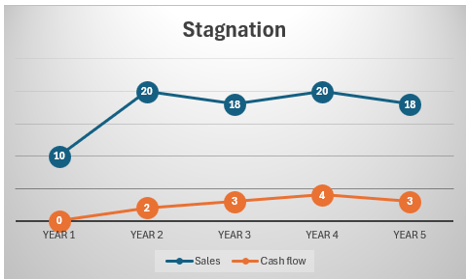

Below is an illustration of a stagnating business

Crisis

Key person risk

No diversified income

No leadership redundancy

👉 One problem—and everything's at risk.

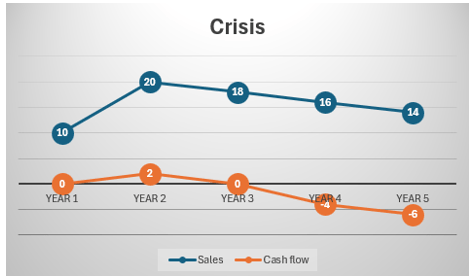

Below is an illustration of a business in the crisis phase

Exit

Business depends on the founder

No repeatable model

No transferable IP

👉 No one wants to buy what only you can run.

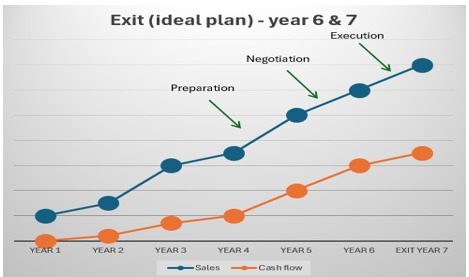

Below is an ideal exit situation with rising sales and rising cash flow during the 3 phases : preparation, negotiation and execution.

These aren’t just structural issues.

They’re emotional realities founders feel in silence—until something breaks.

The Scaling Triangle: The Structure That Solves It

Every business that grows in value—whether it’s Apple or a 10-person SaaS firm—builds around this:

1. IP Monetization

Turn your method, process, or system into recurring income through licensing or productization.

2. Leadership Evolution

Use the Football Model to delegate decisions, not just tasks:

🥅 Defence = Governance

⚙️ Midfield = Ops & structure

⚡ Attack = Vision & scale

3. Global Expansion

Scale your value, not your stress. Use partnerships, licensing, and JVs to enter new markets with low cost and high control.

Founder Stories — From Pain to Power

Case Study 1: Sara — Let Go to Grow

Sara, a SaaS founder in HR analytics, had built a game-changing employee retention algorithm.

But her business hit a wall:

Every proposal needed her sign-off

She hadn’t taken a holiday in 3 years

Scaling felt like adding weight, not momentum

After applying the Blueprint:

She licensed her platform in Singapore — generating £300K/year in passive revenue

She hired a COO and stepped out of operations in 5 months

She expanded to the UAE via a JV with no physical presence

Result:

Revenue tripled

Valuation rose from £3M to £12M

She exited 70% of her shares and now runs a vineyard in Tuscany 🍇

Case Study 2: Daniel — The Business That Couldn’t Run Without Him

Daniel’s AI cybersecurity startup could predict breaches before they occurred.

His tech was revolutionary—but his business was not.

His IP was undocumented and unprotected

He was involved in every client delivery

He rejected licensing deals to “retain control”

When he got sick for three weeks, three clients churned.

During due diligence for a $6M acquisition, investors walked away.

There was no scalable business—just Daniel.

Case Study 3: Rachel — The Consultant Who Built a Legacy

Rachel, one of our 22,000 Blueprint subscribers, began as a freelance CRM consultant in the nonprofit sector.

She saw a gap: non-profits using clunky, corporate CRMs with no guidance.

She launched a consultancy with a mission to empower purpose-driven organisations—and scale without burnout.

Here’s how she used the Blueprint:

Monetized her IP

She turned her internal tools into proprietary templates, onboarding modules, and sector-specific CRM toolkits. These became part of paid subscriptions and licensed services.

Built a team with succession in mind

From day one, she documented processes, developed leadership, and embedded the values in operations.

Scaled internationally

She expanded to Australia by partnering with local nonprofits, training local teams, and adapting delivery while protecting her core IP.

The result?

A successful exit.

Recurring revenue from licensed products.

And a new chapter delivering training programs and public speaking.

She didn’t just build a consultancy.

She built an asset. Where Are You Stuck?

Are you still doing it all yourself? → Startup pain

Are you scaling but suffocating? → Scale-up trap

Is growth flatlining? → Stagnation zone

One staff issue away from collapse? → Crisis reality

Ready to exit but no buyers in sight? → Fixable now

Let’s Fix It — Before It’s Too Late

Join the Exponential Blueprint Program and get:

20 high-impact videos

Monthly execution calls

Templates, scorecards, frameworks

IP & investor-ready tools

Everything you need to scale from chaos to confidence

Because passion starts the business.

But structure builds the legacy.

How Did Our Banking System Get So Messed Up?

Our upcoming podcast with James Hunt, Private Market Expert, promises to be unmissable.

Why? We will uncover how small companies will be able to access capital markets from January 2026.

How big is this? Across the World, this could be up to $14 trillion of untapped small business share trading.

Expert corner:

Marguerite Bolze, M&A Expert from Indonesia

“RETENTION IS KEY”

Successful cross-border Mergers & Acquisitions demand more than just adapting to the local market; they require a deep understanding and integration of the acquired entity's unique culture. A progressive approach to transformation and integration is essential to ensure employees feel valued, informed, and are adjusting positively to changes. Overlooking even a single employee's concerns can significantly undermine the acquisition, leading to poor retention and critical knowledge loss.

It is paramount to recall that the target company was strategically chosen for its inherent value. Their established practices and expertise represent a valuable opportunity for the acquiring business to learn and evolve. Learning is a two-way street; when managed effectively, it fosters a stronger, more resilient combined entity. This human-centric challenge underscores that there's no single blueprint for success.

Curious about effective cultural integration strategies? Let's connect.

Marguerite Bolze

Want to discover how to grap a piece of $3.5 trillion M&A economy? Watch this podcast with Indonesia-based, Marguerite Bolze (14 M&A transactions on record and co-partner at D Davis Consulting, M&A specialists)

Matteo Turi

Founder, Exponential Blueprint

CFO | Entrepreneur | Valuation Strategist

Reply