- The Exponential Blueprint

- Posts

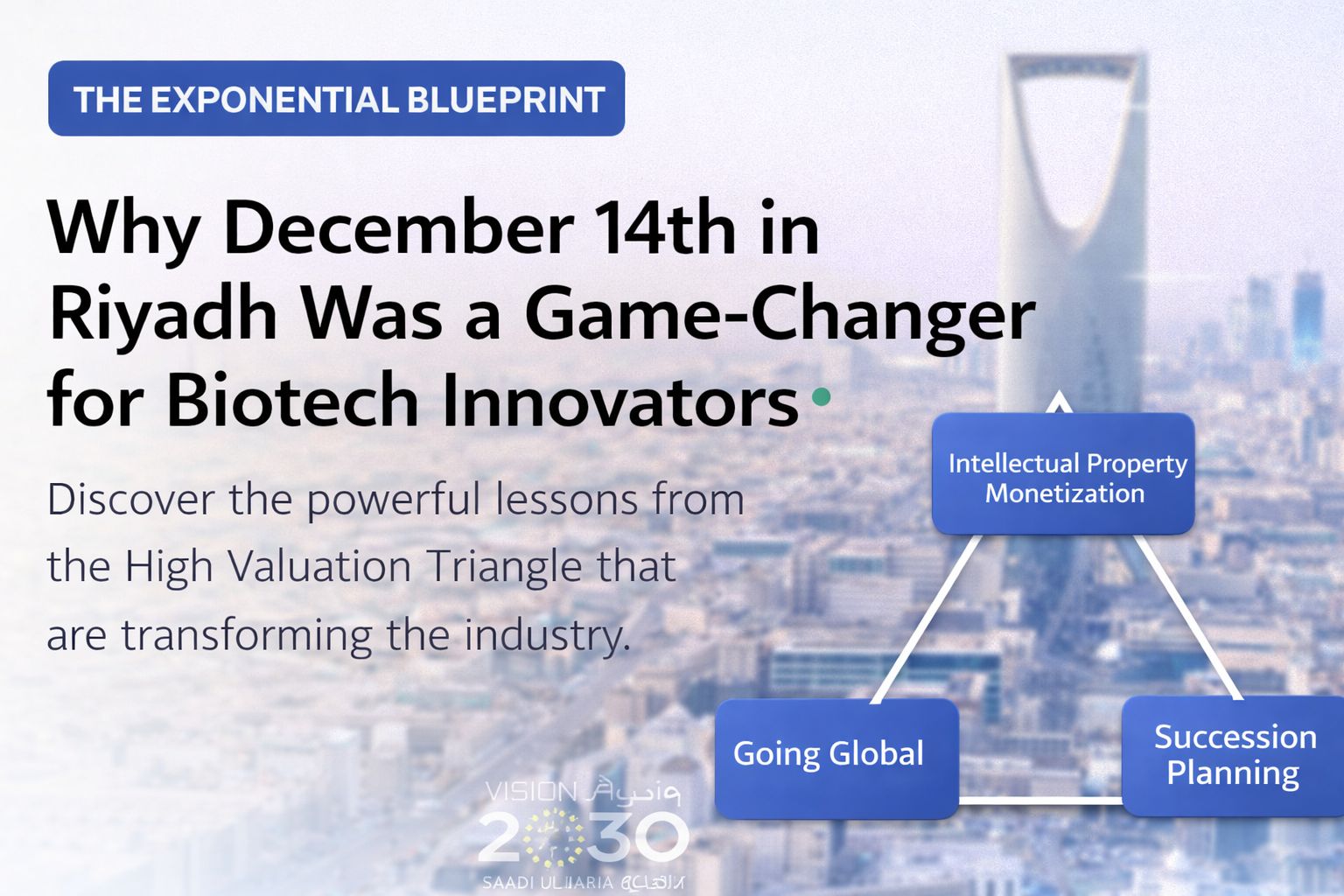

- Why December 14th in Riyadh Was a Game-Changer for Biotech Innovators

Why December 14th in Riyadh Was a Game-Changer for Biotech Innovators

Discover the powerful lessons from the High Valuation Triangle that are transforming the industry.

Why This Edition Matters

On 14 December 2025, Riyadh hosted one of the most consequential gatherings I’ve experienced in recent years.

As part of the Saudi Biotechnology Accelerator, aligned with Saudi Vision 2030, I spent the last two months working with founders, institutions, and investors to answer one critical question:

What actually makes a biotechnology business investable — not just innovative?

The answer, once again, came back to a framework I’ve been using since 2017:

The High Valuation Triangle.

The Riyadh Moment: 91 Founders, One Shared Pattern

On that day in Riyadh, I met 91 biotechnology founders, alongside investors, government bodies, and institutions.

Different technologies.

Different stages.

Different ambitions.

Yet the same structural pattern emerged again and again.

The businesses that investors leaned into weren’t simply the most advanced scientifically.

They were the ones that had structure.

The High Valuation Triangle (Why It Still Works)

The High Valuation Triangle is built on three pillars:

• Intellectual Property monetisation

• Succession planning

• Going global

This isn’t theory.

It isn’t sector-specific.

And it hasn’t aged.

It worked in 2017.

It works in 2025.

And it will work for decades to come.

Especially now.

Intellectual Property: The Real Starting Point

In biotechnology, IP is not a legal checkbox.

It is the economic engine.

What we focused on in Riyadh:

• What exactly is the defensible IP?

• Who owns it — clearly and cleanly?

• How does it translate into revenue, not just validation?

What I saw too often:

Brilliant science without a monetisation architecture.

Investors don’t fund breakthroughs.

They fund defensible, monetisable advantage.

Monetisation: Where Most Businesses Break

Many founders believe monetisation comes later.

In reality, monetisation must be designed early, even if revenues are years away.

Key questions we worked through:

• Is this a licensing model, a platform, or a pipeline?

• Where does recurring value come from?

• What does scale actually look like?

Common pitfall:

Raising capital on hope instead of economic logic.

Succession Planning: The Silent Valuation Killer

One of the most consistent red flags I observed in Riyadh was founder dependency.

Not bad founders.

Exceptional ones.

But still — single points of failure.

What strong businesses showed instead:

• Leadership layers beyond the founder

• Clear decision rights

• Governance that supports growth

Succession planning isn’t about replacing founders.

It’s about liberating the business from them.

Going Global: Where Valuation Multiples Are Born

In biotechnology, local success is not enough.

Global scalability is not optional — it’s structural.

What investors consistently looked for:

• International regulatory pathways

• Cross-border partnerships

• Global capital readiness

Common mistake:

Treating global expansion as a future problem.

In reality, it must be designed from day one.

Why AI Makes the High Valuation Triangle Non-Negotiable

AI doesn’t fix broken businesses.

It amplifies structure — or exposes the lack of it.

Businesses with:

• Clear IP

• Defined leadership

• Explicit growth logic

…give AI a job to do.

Businesses without structure don’t.

This was a central theme in my Riyadh speech — and it resonated deeply.

“AI Doesn’t Kill Jobs. It Kills Weak Business Structures.”

Find out from my article on Substack the 3 new laws in the AI-driven economies.

Businesses with:

• Clear IP

• Defined leadership

• Explicit growth logic

…give AI a job to do.

Businesses without structure don’t.

What Investors Universally Validated

Across conversations with institutions and investors, the same validation appeared:

• IP creates defensibility

• Succession removes execution risk

• Global ambition unlocks exits

Together, they transform businesses from fundable to desirable.

That is the difference between raising money and building value.

Fail. Pivot. Scale. — Not a Slogan, a Cycle

This entire Riyadh journey reflects the philosophy behind my book:

Fail. Pivot. Scale.

Fail — because reality tests every assumption.

Pivot — because structure must replace hope.

Scale — because only then does capital, AI, and growth work.

This is not motivational language.

It is the operating cycle of every successful business.

The book is now available for pre-order on Amazon, including Kindle, for those following this journey closely.

Final Thought from Riyadh

What happened in Riyadh on 14 December 2025 was more than an event.

It was proof that when founders, institutions, and investors align around structure, not hype, economies move forward.

The High Valuation Triangle is not a framework of the past.

It is the architecture of the future.

And Vision 2030 is building on exactly that.

Fail. Pivot. Scale. is built for founders who want to:

Remove hidden structural risk

Monetize what they already own

Escape founder dependency

Scale without fragility

Exit without regret

When you pre-order today, you receive:

✅ 25% lifetime discount

✅ Immediate access to 5 strategic Valuation Scorecards:

1️⃣ Identify Your IP Assets

2️⃣ IP Monetization Models

3️⃣ Pricing Power Through Differentiation

4️⃣ Brand Equity & Legal Protection

5️⃣ Founder vs CEO Role Clarity

These tools are how serious founders turn execution into ownable value.

How to become investable?

I was asked to name 10 commandments!

Below is a link to my podcast with Lily Patrascu

Matteo Turi is a Chartered Accountant (ACCA), Board Director, and CFO with nearly three decades of experience across blue-chip corporations, startups, and scale-ups.

He is the author of Fail. Pivot. Scale: The High Valuation Code Revealed and creator of The Exponential Blueprint, a framework for valuation growth through IP monetisation, leadership succession, and international expansion. Read more at www.matteoturi.com or connect on LinkedIn

Reply