- The Exponential Blueprint

- Posts

- 90% of the S&P 500 Is Now Invisible — Here’s Why It Matters

90% of the S&P 500 Is Now Invisible — Here’s Why It Matters

A quiet revolution has changed how value is created. The new economy runs on intellectual property — not factories.

By Matteo Turi, Executive Contributor at Brainz Magazine

Chartered Accountant (ACCA), CFO, Board Director (FT Board Director Program)

Author of the upcoming book Fail. Pivot. Scale.

www.matteoturi.com

How Intellectual Property Became the New Currency of the S&P 500

The hidden force behind 90% of corporate value — and why founders must treat their IP as capital, not paperwork.

Last week, I had the privilege of joining the Saudi Biotechnology Accelerator (see one of the session banner below) as a mentor and lecturer. The session focused on a topic that sits at the intersection of innovation and finance: how intellectual property converts research and development into capital, partnerships, and exits.

For many entrepreneurs, patents and trademarks feel like administrative steps on the way to something bigger. But in today’s economy, intellectual property is the “something bigger.” It is no longer a support mechanism for innovation—it is the innovation itself.

During my presentation, I called this the new funding engine. Because once protected, an idea becomes an asset. It becomes collateral. It becomes tradable. And ultimately, it becomes the foundation of valuation.

Why Intellectual Property Now Drives Value

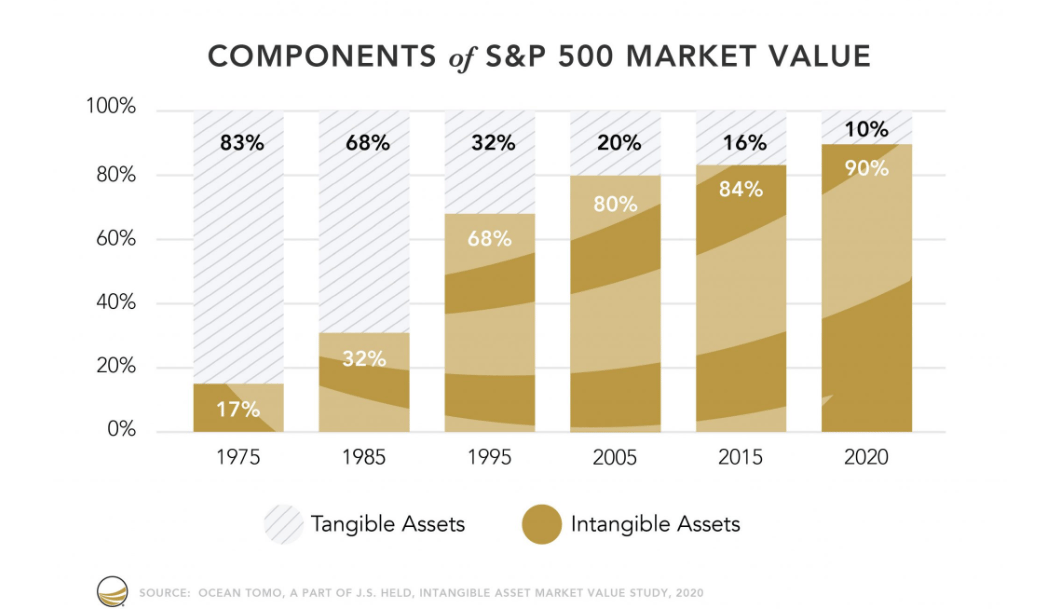

In 1975, tangible assets—factories, inventory, and machinery—made up more than 80 percent of the S&P 500’s total market value. Today, intangible assets represent nearly 90 percent of that value. This shift, documented by Ocean Tomo’s Intangible Asset Market Value Study (2015–2024), is one of the most profound economic transformations of the modern era.

Year | Tangible Assets (%) | Intangible Assets (%) | Main Drivers |

|---|---|---|---|

1975 | 83 | 17 | Industrial capital, manufacturing, equipment |

1985 | 68 | 32 | Brand development, early R&D spending |

1995 | 32 | 68 | Software and early internet growth |

2005 | 20 | 80 | Platform business models, network effects |

2015 | 13 | 87 | Data and technology ecosystems |

2024 | 10 | 90 | AI, cloud computing, intellectual property dominance |

Source: Ocean Tomo LLC, “Intangible Asset Market Value Study 2015–2024.”

Companies such as Apple, Microsoft, Amazon, Google, and Moderna are built on intellectual property portfolios rather than physical production capacity. The same applies to sectors like biotechnology, where a molecule, process, or data model can determine an entire company’s future.

When I mentor founders, I often ask a simple question: “If your offices disappeared tomorrow, what would still make your business valuable?” The answer, if it’s strong, is never a building or a product line. It is the intellectual property that underpins everything else.

Introducing the first AI-native CRM

Connect your email, and you’ll instantly get a CRM with enriched customer insights and a platform that grows with your business.

With AI at the core, Attio lets you:

Prospect and route leads with research agents

Get real-time insights during customer calls

Build powerful automations for your complex workflows

Join industry leaders like Granola, Taskrabbit, Flatfile and more.

What Most Founders Miss

Despite this reality, many entrepreneurs still approach fundraising without a robust IP narrative. They show market traction but no patent roadmap. They discuss growth but not ownership.

At the Saudi Biotechnology Accelerator, I saw both the pitfalls and the potential of this mindset.

A negative case study involved a biotech team that developed a promising therapeutic compound but delayed filing their patent. Their university collaborator registered similar claims first. By the time investors conducted due diligence, the startup’s valuation collapsed. The research was strong, but the protection was weak.

A positive case study, on the other hand, involved a diagnostics startup that filed early, converting its data into patentable claims and securing priority in key markets. When investors came on board, they saw defensibility, not just discovery. That single decision tripled the company’s valuation and shortened its fundraising timeline.

The difference between those two stories is not science—it is strategy.

From Discovery to Valuation: The High Valuation Triangle

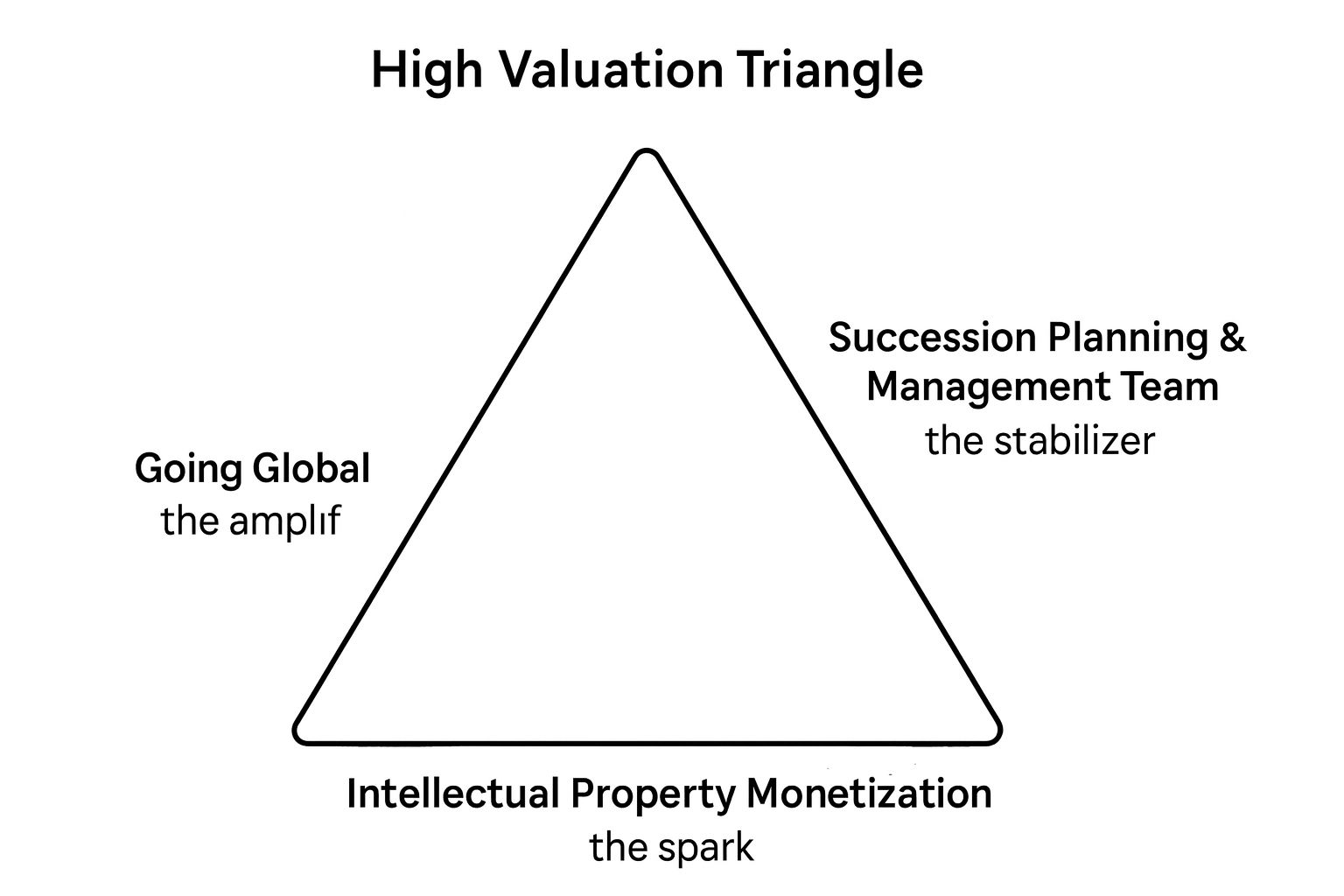

This is where my High Valuation Triangle™ framework comes in, which I explain in my upcoming book Fail. Pivot. Scale. The triangle illustrates how businesses can deliberately engineer valuation growth by aligning three core elements:

Intellectual Property Monetization – Protecting and leveraging what makes you unique.

Leadership and Succession Planning – Building a team that can sustain growth.

Global Scalability – Turning IP into repeatable, international business models.

The High Valuation Triangle changes shape as a company evolves. During the startup phase, IP sits at the top, forming a narrow yet critical apex. In the scale-up phase, leadership and systems strengthen the base. In times of crisis, the triangle inverts, forcing the company to reassess what remains defensible. In stagnation, it flattens as innovation slows and strategic renewal becomes essential. Finally, at exit, it reaches balance—where intellectual property, leadership, and market reach are all aligned, creating investor readiness and maximizing valuation.

This geometric metaphor isn’t abstract. It helps founders visualize how their internal focus must evolve from protection to profit to partnerships over time.

The High Valuation Code: A Live Journey from Fail. Pivot. Scale.

The High Valuation Code is the live, interactive journey that brings my upcoming book Fail. Pivot. Scale. to life.

While the book reveals the strategy behind transforming setbacks into scalable value, The High Valuation Code guides founders through executing those strategies in real time.

It combines the High Valuation Triangle — intellectual property, leadership depth, and global scalability — with practical tools, scorecards, and investor-ready milestones.

Each week, members apply the lessons directly to their business, track measurable progress, and eliminate blind spots that stall valuation. This is not just education. It is transformation built alongside a CFO who has scaled companies on both sides of the table.

Biotechnology in the Age of AI

As artificial intelligence reshapes industries, many professionals fear job displacement. Yet some sectors, particularly biotechnology, are positioned to thrive. AI accelerates discovery, but it does not replace ownership. Algorithms can suggest molecules, but they cannot hold patents. Human ingenuity remains at the center of value creation.

This convergence—AI as the discovery tool, IP as the protection layer, and capital as the growth driver—defines the next era of high-valuation businesses. Biotech, deep tech, and AI-enabled platforms all share a common requirement: a solid intellectual property foundation.

The Future of Funding and Innovation

In my lecture at the Saudi Biotechnology Accelerator, I encouraged founders to see IP not as a cost but as leverage. A strong IP portfolio unlocks diverse funding pathways:

Equity, by signaling defensibility and accelerating investor confidence.

Debt, by enabling IP-backed financing and venture loans.

Non-dilutive capital, through licensing, royalties, and co-development.

Strategic partnerships, with larger biotech and pharmaceutical firms.

For founders navigating today’s capital markets, understanding how intellectual property translates into value is no longer optional—it is existential.

My Debut in Brainz Magazine

My first article for the prestigious Brainz Magazine is now published: “Why Growth Is Not Enough: The New Language of Value Creation.” It explores how founders must move beyond revenue and engineer valuation through intellectual property, leadership depth, and global scalability. I am honoured to share these insights with an international audience of innovators.

Our M&A Expert Corner, Marguerite Bolze from Indonesia

Employee Stress: The Real M&A Dealbreaker.

Navigating the period of a merger or acquisition (M&A) is inherently stressful for all employees, regardless of whether they are on the core integration team or simply witnessing the organizational change from the sidelines. The stress stems from pervasive uncertainty—concerns about job security, changes to roles and responsibilities, cultural misalignment, and new reporting structures. If this significant emotional and mental toll is disregarded, it can lead to tangible negative consequences, including a sharp decline in productivity, increased employee turnover (especially among high-value talent), and a general atmosphere of disengagement and resistance that severely undermines the successful realization of the intended deal synergies. Therefore, actively managing employee stress is not merely a soft HR concern but a critical factor in protecting the financial and operational value of the entire M&A transaction.

-------------------------------------------------------------------------------------------

Capture the value from your M&A! Schedule a call with us!

Marguerite Bolze

Watch my podcast with Marguerite Bolze

Final Reflection and Call to Action

The companies dominating the S&P 500 did not grow because they made more products; they grew because they built stronger intellectual property ecosystems. Their success is proof that the global economy has transitioned from producing goods to protecting ideas.

If you are a founder or executive preparing to raise funds, ask yourself three questions:

What part of your business is truly defensible?

How can you make that defensibility measurable and valuable?

And who inside your company is responsible for protecting it?

These questions sit at the heart of the High Valuation Triangle and form the foundation of my upcoming book Fail. Pivot. Scale., where I explore how founders can transform failure into strategy and strategy into scale.

P.S. You can join the waitlist and learn more about building valuation, not just revenue, at www.matteoturi.com/exponential-blueprint.

Because in today’s world, the fastest way to grow your company’s worth is not by owning more things—but by owning more ideas.

To Your Exponential Success,

Matteo Turi

About the Author

Matteo Turi is a UK-based Chartered Accountant (ACCA), CFO, Board Director (FT Board Director Program), and author of the upcoming book "Fail. Pivot. Scale."

He is the creator of the High Valuation Triangle™, a system that helps businesses engineer valuation growth through intellectual property, leadership depth, and global scalability.

Matteo also writes The Exponential Blueprint, a finance and entrepreneurship newsletter read by 22,000+ founders and investors.

From October 2025, Matteo has become Executive Contributor with the Brainz Magazine.

Connect on LinkedIn for insights on scaling with resilience and purpose.

Reply